Business Funding Team

Nearly all people globally will want a loan at some point in their lives. The most important thing at such a time is to look for a reputable financial institution. It is good to go for a lender who has the shortest turnaround time and offers the best interest rates.

The best company should also have a broad range of products that are designed to meet various customer needs. For the case of the United States, the Business Funding Team is your number one choice for financial support.

There comes a time in life when all that you need to be able to move forward is a loan. In the United States, we have to many companies that offer financial solutions to those who are in need. However, you should not go for any of them blindly. Even if you are in a crisis, make sure you understand the terms of each product before you take the loan.

No one wants to discover that he went for a very expensive option when the amount is already on the account. So many people have fallen prey to this trap and you don’t want to become a victim. It is good to go for a brand that does not hide anything from you.

With all this information in mind, you will discover that the most reputable lending institution in the region is Business Funding Team. We offer a broad range of products to our customers regardless of their needs. The good thing is that all of them come at very competitive rates. You will not find such great deals in any other lending company in the region.

Business Funding Team

Your number one choice for any type of loan in the United States of America is Business Funding Team. We have been in this business for several years and have a long list of happy customers. The reputation of our brand speaks for itself because of the quality of services that you will get. Key among them include the turnaround time and interest rates. We take the shortest time possible to process the loan and offer loans that are highly affordable.

Besides, we have enough funds and hence can give you any amount of loan. It does not matter whether you are a small business or a corporate. The company values all our customers and strive to give all of them the best service possible. There is a broad range of services and you will not fail to get one that matches your needs perfectly. In the next section, we are going to look at some of the top loan products that we offer to our customers.

Looking for a first-class financing solutions company?

Here at Business Funding Team, we love educating you on the funding process, whether you are a startup or an established business. So below are two of our preferred funding partners that we highly recommend. Business Funding Team has provided the top funding solutions for thousands of entrepreneurs nationwide. You can read about them by clicking either of the two buttons below

Feel free to apply for any of them and we will be glad to serve you in the best way possible.

Below you have a view of some of the loan products that we offer to our esteemed customers.

Startup Funding

As a startup, you could be having a hard time in trying to get funds for your business. Most lenders in the United States prefer to deal with established brands and not business starters. The truth of the matter is that even the leading multinationals started as small businesses.

If no one funds startups, we will be killing so many future corporate businesses. Our company values people who come up with business ideas. We will help you to nurture it by lending you the capital that you need most.

Startup Funding for Business

You can have a brilliant business idea but it will be meaningless if you don’t have the required funds. In fact, most of the small businesses that fail are a result of insufficient funds. The challenge is that most lenders disagree with the idea of funding startups because they don’t understand their cashflows. We will use your business plan to determine the loan amount that will work for you best.

Startup Funding for Small Business

If you want funding for your small business, there are several options that you can use. However, the best one is looking for a business loan. Even though not all lenders will give you such a loan, you can count on us for the best financial support.

Startup Funding Website

The number of websites that fund startups in the United States are countless. However, some of them charge exorbitant interest rates to customers. It is advisable to use our services because we will not take advantage of your situation and charge you exorbitant interest rates. Since the application process is online, we will disburse the loan to you within no time.

Startup Funding for Nonprofits

Most nonprofits struggle to get startup funding because they are not in productive business. However, all we need is a guarantee that you will repay the loan and we will disburse it to you. We have funded so many nonprofits startups and I can assure you that they are doing great.

Startup Funding Companies

Even though we have several companies that fund startups in the region, you need to be careful when choosing one. Since you are starting business, you need flexible and affordable installments. It is good to analyze what various startup funding companies have to offer before choosing one of them. We are the best brand in the region for all your startup capital needs.

Startup Funding Options

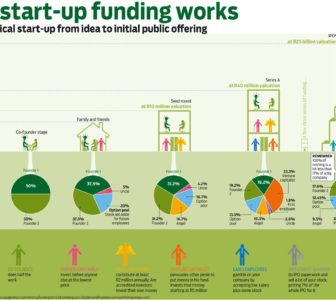

Some of the options that you have for funding your startup include IPO, crowd funding, own savings, donations, and contribution from friends and relatives. However, it can be challenging to secure business startup funds from all these options. When things don’t work, it does not mean that you do away with the implementation of your business idea. Visit us and we will help in financing your new business.

Startup Funding Sources

Even though there are several sources for financing your new business idea, the best one is getting a loan. You will repay the amount with some interest but you have a guarantee of getting the funds. Our company is top on the list when it comes to funding new business ideas.

Startup Funding Stages

There are several stages when it comes to funding a new business. There is need to carry out a thorough research so that you don’t put your funds in a business that will not succeed. You also need an alternative source of income just in case the business does not succeed.

Startup Funding Online

When applying for capital to start a new business, you can get it from us online. The application process is simple and you can get the funds in a matter of hours.

How Startups Get Funding

Most people don’t know how startups get funding. Even though we have several options, loaning comes top on the list. Our team will examine your business idea and if it is viable, we will give you the money that you need to implement it.

Business Funding

Almost all the businesses that you see thriving in the United States rely on loans. We have very few people who can use their own savings to run a business. The good news is that several banks are willing to fund your business as long as it has the ability to pay the loan. When you analyze the terms and conditions of different lenders, you will discover that we emerge as the best option for business funding.

Business Funding Fast

If you have an LPO and apply for a business loan, it will be meaningless to get the money after the order has expired. The same case applies if you want funds to run you through a peak season. We have the fastest loan processing times so that you don’t miss out on any opportunity.

Small Business Funding

If your small business is struggling because of lack of funds, you don’t have to worry any more. The Business Funding Team has excellent loan products that are specially designed to help small businesses.

Business Funding Partners

One of the most important business funding partners is the financial institution that gives you loans. You need a brand that will boost your working capital so that you can remain in business. Our company is the best if you are looking for a reliable source of fund for your business.

Business Funding for Startups

So many people have amazing business ideas but they don’t have the funds to set everything rolling. Gone are the days when money would stand between you and your business success. Once we discover that your business idea is feasible, the best that we can do is to give you the funds that you need most.

Business Funding Solutions

No business can succeed without sufficient working capital. The best solution to increase your liquidity is going for a loan. It will make sure that all the operations in your business are running smoothly. Our company has various loan products and you won’t fail to get one that will serve you well.

Business Funding with Bad Credit

Having a bad credit history does not mean that you will never get a business loan. There are several reasons that can make lenders to blacklist their customers and some of them are things that we need to understand. Therefore, we don’t write off anyone but assess each situation and help you get business loans. With time, you will improve your score and even get bigger loan amounts.

Business Funding for Veterans

Veterans are people who have a lot of respect in the United States. As a financial institution, we acknowledge these people by giving them very affordable loans. If you are one of them, you can get excellent business loans from our brand. These loans are always cheaper than what we give to the other customers.

Business Funding Group

We have the best business funding group in the region. You will get all types of loans regardless of the nature and size of your business. Our products are designed to meet your business needs with the highest level of precision.

Business Funding Capital

All businesses require capital to be able to operate smoothly. One of the challenges that most entrepreneurs face is a limitation of working capital. To overcome this challenge, you can come to us for business funding capital.

Small Business Loans

The main challenge you could be facing as a small business owner in lack of stock. You cannot serve your customers efficiently unless you have enough capital. Such things can paint the reputation of your business in the bad light. We will help you to overcome these challenges by availing the money that you need in form of a loan.

Small Business Loans for Woman

Some of the most successful entrepreneurs around the world are women. The main challenge that most of then face is lack of funds. Our company has a special product that caters for the needs of women who are running small businesses in the region.

How to Get Small Business Loans

The process of getting small business loans should not be complex. These are small amounts that a lender needs to with minimal requirements. For the best deals, all you need to do is visit us and we will be able to help you out.

Small Business Loans for Startups

In most cases, startups begin as small businesses and anticipate to grow. You can save to start a new business but the amount will rarely be sufficient. It explains why we offer small business loans to startups. Most of the corporate customers that we have right now started at this point. The secret is just learning to take one step at a time.

Small Business Loans for Veterans

We give veterans the best treatment when it comes to business loans. If you fall under this category, you will get very affordable loans for your small business.

Small Business Loans Rates

One thing that we understand is that small business needs a lot of money to achieve the desired level of growth. You cannot achieve this objective if you pay a lot of money in the form of interest on loans. It explains why we strive to give our small business customers the most competitive rates on loans.

How Do Small Business Loans Work?

The primary reason of taking a small business is to help you boost your working capital and grow your business. The amount that we give you is what your business can pay comfortably so that it can have a positive impact on your brand.

Small Business Loans New Business

Most new business owners fear taking loans because they don’t know the fate of their business. However, we will assess your business idea and advice you accordingly. The most important thing is to make sure that the funding help in enhancing your business.

Small Business Loans Online

Our small business loans are the best because you can apply for them online. We just need minimum information from you and we will be able to disburse the amount to you. The whole process is automated making everything quite easy for the borrower.

Small Business Loans Near Me

To get a small business loan, it is advisable to go for financiers within your location. The loan officers can come to visit your business premise and advice you on the best way forward. It explains why most small business owners run to us for loans. The company has great products for the people who reside within our vicinity.

Rates for Small Business Loans

When going for a small business loan, you have to pay close attention to the interest rate that you will be paying on top of the loan amount. If the amount is too high, it will end up eating into up into your working capital. For this reason, we offer the lowest interest rates for our small business customers.

Small Business Loans for Minorities

In most regions in America, you will find financial institutions discriminating against the minorities. However, this is not the case when you are dealing with our brand. We have special products for these people so that they can boost their businesses.

Small Business Loans for Disabled Veterans

Disabled veterans who own businesses need special treatment. These are people who found themselves in the disadvantaged state in the course of serving the state. To help such people, we give then loans at very affordable rates. If you know of such a person, kindly refer them to our website.

Qualifications for Small Business Loans

The ability to repay is the main qualification for anyone who wants to get a small business loan. You stand a higher chance to get the loan if you have an alternative source of income. The application process is less simple in comparison to the other types of loans.

Small Business Loans Unsecured

Most people don’t know that you can get small business loans that are unsecured. We have been helping a long list of customers to secure small business loans in the region. Most of them are now corporate brands with a long list of customers.

Where to Get Small Business Loans

Several financial institutions provide small business loans but some disburse very little amounts while others charge exorbitant interest rates. For the best small business loans, it is a wise move to come to us.

Small Business Loans Quick

There comes a time when small business loans become a matter of urgency. For instance, you may want to take advantage of the peak season. Our financial institution is the best choice as we will take the least period to process your business loan.

Small Business Loans Companies

If your company has not grown so much, you may find it hard to secure business loans. Some institutions only deal with companies that have broken even. However, we are very different because you can get small business loans for companies with very minimal hassle.

Small Business Loans Amount

The amount of loans that we approve for small businesses depends on what your business needs. Both overfunding and underfunding is not good for any business regardless of the size. We have experts who know what will work best for your brand.

Unsecured Loans

Our company also has special products for those who are shopping for unsecured loans. You don’t need any form of collateral to access such loan. We mainly evaluate your current cashflows and credit history before disbursing unsecured loans. You can use the loan amount for various purposes including home improvement, school fees, business expansion, and medication to name a few.

Unsecured Loans Personal

We also offer unsecured personal loans to our customers in the United States. Most people who love this loan product are those on a steady monthly income from their employers. The most important thing is to take home an approved fraction of your salary at the end of the month. These are standards that are put in place by the government to make sure that people don’t over-commit their pay slips.

Unsecured Loans Debt Consolidation

The best way to deal with debts is consolidating them. If you have so many of them, it can be so hard to track them and know which one is due. It is better to have one product and we will help you in consolidating all of them into one.

Unsecured Loans to Consolidate Debt

One reason for taking an unsecured loan is to consolidate all your debts. It is an excellent way to track your debts. We are the best company to help you to consolidate your debt in one single loan product.

Unsecured Loans Rates

Are you looking for the best rates on unsecured loans? Your search has come to and end. You will get the lowest interest rates on secured loans from us. The fact that you are not providing a collateral does not mean that we will overcharge you. As a brand, we have the best interests of our customers at heart and hence will not take advantage of your state.

Unsecured Loans vs Secured

If you don’t have a collateral, you can choose to go for unsecured amounts. If the amount is too low, you can increase your limit by securing it. The choice that you make depends on your loan needs and ability to pay. As a company, we offer these two loan products to our customers. In both cases, we try our level best to give you the best rates in the market.

Unsecured Loans for Business

If you want an unsecured loan for business, we are here to serve you. Our company has the best products to help you add stock to your business and fund other activities.

Unsecured Loans Online

It is a good thing to consolidate apply for your personal loan online. We will check your credit history, validate your information and documents, and then disburse the loan within no time. Our team is highly efficient when it comes to processing unsecured loans online.

Rates for Unsecured Loans

We offer the best rates on secured loans in the market. Let no one cheat you that unsecured loans are always expensive. We are here to disagree with this thought by giving you unsecured loans at very competitive rates.

Unsecured Loans Near Me

Our company is your number one choice if you want the best unsecured loans near me. We have so many success stories from people who have been taking unsecured loans with us. Depending on the way you intend to use the loan amount, you can be sure of getting maximum support from us.

Unsecured Loans Interest Rates

We have the most competitive interest rates for unsecured loans. Gone are the days when personal loans used to be very expensive. If you need the best rates for personal loans with no hidden charges, feel free to contact us today.

Unsecured Loans for Veterans

As a company, we give special consideration to veterans when applying personal loans. We have products that are tailored for this group of people. We give them bigger loans with more flexible repayment terms. As our heroes, we also have a special consideration for them when it comes to interest rates.

Unsecured Loans Types

There are different types of personal loans in the region of America. The categories mainly depend on your income type. We basically offer all types of unsecured loans to our esteemed customers. If you need any of them, don’t hesitate to call us.

Unsecured Loans Best Rates

Currently, we offer the best interest rates for personal loans. The good thing is that you will not require any collateral to secure such a loan. If you have a salary, it will even take a shorter time to get the unsecured loan. The only thing we need from you a sufficient proof that you can repay the loan.

Unsecured Loans Low Interest

Unsecured loans are known to be expensive but this is not the case with Business Funding Team. We offer the best interest rates to our clients for all the unsecured loan products. It is for this reason that we command the whole region when it comes to unsecured personal loans.

No other brand beats us when it comes to startup loans, small business loans, unsecured loans and other loan products in the region. Come to us for speedy fast loan processing, great interest rates, and flexible repayment periods. Business Funding team is in deed your listening and caring financial partner.

Unsecured Loans Companies

Of all the companies that give unsecured loans to customers, we are top on the list. The first aspect that we score highly is the element of cost. We have very competitive rates for the unsecured loans in comparison to the other service providers. The other strength is the fact that we have the best turnaround time when it comes to processing unsecured loans in the United States of America.

Creative Financing

The term creative financing refers to a non-traditional approach to purchasing a property or land in the real estate industry. You should not have a lot of cash at hand to be able to acquire a property. Such a high level of flexibility allows even small business owners to acquire property in the modern business environment that is highly competitive.

Creative Financing Ideas

Our company has the best creative financing ideas that you can think about. We always look at your cash flows to determine the best payment schedule. This knowledge helps us to come up with the best loan product that is unique to your needs.

Creative Financing Strategies

There are so many strategies that you can use when coming up with creative financing strategies. The most important thing is to come up with products that fit into the income of the individual perfectly. Therefore, you cannot achieve this objective unless you have a clear understanding of the income streams of the borrower.

Creative Financing Solutions

Several advantages come with creative financing solution. It helps the borrower to acquire assets and expand their businesses yet they don’t qualify for traditional loans. It is a product that most consumers run for because it adapts to their income.

Creative Financing Options

With creative financing options, even buyers who have a bad credit history can get a loan to but a home, land, or any other property. You should not have a lot of cash at hand as your own contribution to be able to secure such a loan. We take a very flexible approach to financing so that everyone can qualify for a property loan.

What is Creative Financing

Nowadays, you don’t have to accumulate a lot of money to be able to acquire a property. You can take the rest of your life trying to look for such money but in vain. Mortgages and other development loans also seem to be so expensive to most people. Creative financing provides a more flexible approach to acquiring land or a property. You will get this loan even if you don’t have initial down payment.

Creative Business Financing

Business cycles vary from one industry to another. Therefore, it is good to have loan repayment periods that reflect your business cycles. This knowledge reflects the basis for our creative business financing. We tailor-make all products to give you a flexible repayment system.

Real Estate Investor Loan

It is hard to invest in real estate using your savings because the amounts involved here are so huge. One of the best options is going for a loan. The good thing is that you can use the same property to secure the loan hence increasing your possibility of getting the loan.

Real Estate Investor Financing

Not all lenders in the United States have the capacity to finance real estate projects. These ventures require heavy capital investments and hence only serios financial institutions can undertake them. We offer any amount in real estate investor funding at very affordable interest rates and flexible installments.

New Venture Funding

Most of the lenders in the region shy away from funding new ventures. The reason is that there isn’t and data on cash flows. However, we use our current knowledge in the industry to predict the performance of your brand with a high level of precision. We have a lot of experience in the industry and we use it to make informed decisions when funding new ventures.

Secured Loans

Secured loans are far much better than the unsecured ones in several ways. If you have a collateral, it is advisable to secure your loan. The reason is that additional collateral gives you access to bigger loans at more affordable rates.

Secured Loans Online

The good thing about the internet is that you can apply for secured loans online. There is a place to fill in your information and upload all the necessary files. The loan officers will verify all the information and documents that you provide and approve the loan. It is one of the most efficient ways that people use to get loans from our company.

Secured Loans for Bad Credit

If you have a bad credit history, one of the best ways to get a loan is securing it. Such a step tells the borrower that you are committed to paying your loan. After all, no one wants to lose his valuable asset because of default.

Secured Loans with Bad Credit

Even those people who have a bad credit history can get access to secured loans. There is nothing that will hinder us from giving you the loan if you have gone an extra mile to secure the loan. The most important thing is to do security perfection and then avail the funds to you.

Secured Loans for Business

If you own a business, you can get more funds for expansion by securing it. The banks accept a broad range of assets as collateral including the title deed and logbook among others. It is good to confirm with the financial institution about the items that they accept as collateral.

Secured Loans vs Unsecured Loan

If you have a collateral, it is always advisable to secure your loan whether it is for business or personal needs. It increases the confidence of the lender in the borrower and hence you will get better terms. Secured loans are always larger in amounts and attract lower interest rates.

Secured Loan Collateral

There are so many assets that banks accept as a collateral for secured loans. The main ones include machines like cars and real estate. You have to prove ownership of these assets before using them to secure a loan with us. It is good to go through the list that the financier accepts before you use the asset to secure the loan.

Secured Loans Types

There are different types of secured loans and you can get all of them at the Business Funding Team. The main differentiating factors include the price and the purpose of the loan.

Startup Business Loan Bad Credit

If you want a startup loan but have a bad credit history, you can turn to us. You can even get large sums of money especially if you choose to secure the loan. The fact that you have a poo credit score does not imply that you lack the ability to service a business loan.

Secured Loans Rates

Nearly all secured loans in the region attract lower interest rates and we are not an exemption. After all, securing a loan is not expensive yet you will save so much in terms of interest rates. The borrower ends up as the ultimate beneficiary when he chooses to secure his loan with us.

How Does Secured Loans Work?

To secure a loan, you need to provide a collateral that own as a collateral. If you don’t have an acceptable asset, you can request for one from a family or friend. The bank will legalize the whole process by undertaking what we call security perfection.

Once the process is over, we will disburse the approved loan amount against the security. Once you clear your loan, we will de-register it and give you back your documents. You are free to use the asset in any way that you wish after you have cleared the loan. However, you continue using the asset as you service the loan but you can never sell it with an outstanding balance.

Secured Loan Debt Consolidation

It is very frustrating to have so many small loans because some of them are extremely expensive like the credit cards. When you are in such a state, you will discover that your credit score will begin to go bad. You can save yourself by taking a secure loan that is cheaper to pay off all these loans. This will also help you to manage your debt in a better way.

Startup Business Funding

With a brilliant business idea, you can be sure of getting business financing from our company. In the past, we have funded so many small businesses and right now they are corporates.

Business Funding for Startup

The startups that we fund cut across all the industries in the United States. Therefore, apart from giving you the money, we also give you great business ideas. We also link you to other stakeholders who can be your customers, suppliers, and business partners among others.

Startup Business Loan Rates

Since startups have a long way to go, we don’t charge them big interests. The reason is that these people need to save much and re-invest in the business to attain the desired level of growth.

How to Get Startup Business Funding

To get a loan for your startup business, you need to proof the existence of your business through the business permits. We may not require so much of business records since you are just starting. However, you may need to furnish us with your business plan to help us understand your business goals.

SBA Loan

SBA guarantees loans for small business owners to help them qualify for loans that would not otherwise have qualified. You will be able to get large amounts of money at rates that are highly competitive.

SBA Loans Requirements

SBA has set requirements that you need to meet to qualify for these loans. In most cases, you should be an American citizen and preferably own a business. You will get the loan from a third party like the bank but SBA only provides the guarantee.

SBA Loans Rates

The rates of SBA loans are relatively cheap in comparison to the other loans products because the agency guarantees approximately 80% of the loan amount. It is an excellent way for small scale entrepreneurs to secure working capital for their business.

SBA Loans 504

If you qualify for SBA loans 504, it is good to take them because they are much cheaper than the other loan products. We partner with this agency to give you the most competitive loan rates in the region

SBA Loans Disaster

In case you undergo any disaster that affects you economically, you can apply for SBA disaster loans. We partner with this agency to help our customers during such hard times. These loans will help you to resume your normal life within the shortest time possible and have very minimal interest rates.

SBA Loans Interest Rate

According to the terms and conditions of SBA, these loans come at a cheaper interest rate. A lender who is not willing not adhere to these terms will not be allowed to disburse the loans.

Terms for SBA Loans

SBA does not disburse any loans but relies on third party lenders to give loans to the target audience. All the agency does is to provide a guarantee of the loan. These terms and conditions allow the beneficiaries to get higher loans at better rates. If the lender violates these terms and conditions, he will not be allowed to disburse the loans.

SBA Loans Real Estate

If you are planning to invest real estate, one of the best products to go for us SBA loans for real estate. The program has helped so many people who would not have afforded real estate to own property throughout the United States.

SBA Loans for Veterans

Veterans also have a special package under the SBA loans. The Small Business Administration will guarantee the loans and the borrower will get highly subsidized interest rates.

SBA Loans for Women

To promote women empowerment, SBA has special products that gives them bigger loan amounts at rates that are more affordable. If you are a woman and want to benefit from some of these products, feel free to secure a loan through our brand.

SBA Loans Business

SBA loans are specially designed for small business owners who want to purchase fixed assets and increase their working capital. If you have a challenge getting a loan, this program will help you get one faster and more cheaply.

SBA Loans Types

There are different types of SBA loans depending on how you intend to use the funds. You can always confirm with the lender on what is available before making a decision.

SBA Loans for Small Business

SBA loans are specially designed for small business owners. You can use them to reach new heights that other small business owners can never attain. Most people prefer to use these loans to purchase assets.

SBA Loans Programs

SBA loans programs have benefited so many people in the United States because they are more affordable and comfortable financing options. If you are not sure of where to get these loans, you are welcome to visit our brand for the best solutions.

Business Lines of Credit

The use of business credit lines is gaining popularity at a very fast pace in America. The program works in the same way as a credit card but is specially designed for small businesses. It allows these entrepreneurs to access credit at any time as the need arises.

Lines of Credit for Business

One of the best ways to get quick cash as a small business owner is going for lines of credit. The bank will set a limit for you beyond which you cannot exceed. The amount that you get as a limit depends on your credit score, current cash flows, and the amount of debts that you are carrying.

Lines of Credit Loans

If you have lines of credit with us and you feel that the limit is too low, you can always apply for an extension. We will be happy to give you a higher limit as long as you qualify. The most important thing is to get the funds that you need to grow your brand.

Lines of Credit Personal

With the lines of credit, you can use these funds as you so wish because we will not follow up on you. The most important thing is to repay on time to avoid penalties. You can use the money for your personal needs such as emergencies.

Lines of Credit for Small Business

Even a small business qualifies for the lines of credit with our company. As the brand continues to grow, we can always increase your limit. Once we can trust you with a small amount, it will not be hard to trust you with huge sums of money.

Lines of Credit Online

The good thing about line of credit is that you can apply for it online and we will process your request. The most important thing is to make sure that you give us accurate information about your credit worthiness. You will not have to make several visits to our office before we can approve your request.

Interest Rates for Lines of Credit

Even though lines of credit attract a higher interest rate, the case is quite different with us. We charge the most competitive rates for lines of credit in the region. Don’t go for lenders who will overcharge you yet we are here to help you out.

Lines of Credit vs Loan

Lines of credit is a faster way of getting a loan for business purposes even though it will cost you slightly higher than the other loan products. Once you have a limit, you can avail the funds in your own at any time. Most people prefer it because of the high level of flexibility.

How to Get Lines of Credit

To get a line of credit, you need to make an application as long as you own a business. Our team will evaluate your credit worthiness and give you a limit that you can use to borrow a loan.

How do Lines of Credit Work?

Lines of credit work exactly in the same way like the credit card. The lender will score you and you will spend the available amount as you wish. The good thing is that you will only pay interest for the amount that you use. Timely payment means that you can get limit extension.

Equity Lines of Credit Rate

The best place to get equity lines of credit is the Business Funding Team. In case you have an urgent need for money, you will make a withdrawal with immediate affect without having to run up and down in search for a lender.

Lines of Credit Rates

The good thing about lines of credit is that they are highly effective. However, most lenders agree to the fact that these loans come with a higher risk. As a result, their interest rates are always higher than what you pay for the other loans in the market.

Business Lines of Credit Rates

The interest rates of credit lines are slightly higher than the ordinary loans that you know. However, it is worth the take because of the high level of flexibility.

Apply for Lines of Credit

Feel free to visit our site to apply for credit lines. All the terms and conditions are stipulated in the respective section. It will take us a few days and your lines of credit will be ready.

Lines of Credit Loans for Bad Credit

The good thing about lines of credit loans is that you can get them even if you have a bad credit history. We evaluate your current cash flows in order to gauge your ability to pay.

SBA Loans Application

To apply for SBA loans, you must meet the requirements that both the lender and the agency provides. The application process is not complex and anyone who qualifies for the loan can submit an application.

MCA Loans

Merchant cash advance are given against the funds that you expect to receive from credit cards. It is one of the best credit solutions for modern businesses and you can get it from our brand.

MCA Business Loans

One of the best business loans in the market is the merchant cash advance. We use at how much you earn from credit cards and use the date to grant you a loan. You need to use these funds to pay your loan once it is due.

Merchant Cash Advance

If you want merchant cash advance, we are your ultimate solution. We charge the most competitive rates for this type of loan in the region. Besides, we will give you any amount that you want as long as your business has the ability to pay.

Merchant Cash Advance Companies

There are so many merchant cash advance companies in the region but we are the best. If you want to get bigger loan amounts in this product, you need to encourage your customers to use their credit and debit cards in making payments.

Merchant Cash Advance Loan

Businesses that accept payment through credit and debit cards stand to benefit from the merchant cash advance loan. Therefore, you should not accept to listen to anyone who will discourage you from this. The more you use these cards, the higher the limit you will have for merchant cash advance loans.

Shark Loans Online

The beauty about our shark loans is the fact that you can apply them online. You don’t have to waste time walking to our offices and submitting physical documents. With automation, you can be sure of accessing the loan in the most efficient way possible.

Shark Loans Bad Credit

Most people apply for shark loans when they are in a state of emergency. It can be so frustrating for someone to deny you this opportunity on the basis of your credit score. Out company will disburse these loans to you even if your credit history is wanting.

Funding for Companies

A large proportion of our loan book is made up of loans that are disbursed to companies. Most of them are large amounts and you will not get them from a lender who does not have sufficient capacity. Therefore, if you are a company owner, just know that we are the number one solution for all your financial needs.

What is Merchant Cash Advance

Businesses that allow customers to pay their bills using credit cards will get access to merchant cash advance. The lender will analyze the amount that you get through these cards and disburse a loan to you against those sales. The expectation is that the money you get from the credit cards will be used to service the loan.

Merchant Cash Advance Bad Credit

You can still get merchant cash advance even if your credit history is bad. A poor credit score does not necessarily imply that you are a bad person. There are so many things that can make a lender to blacklist you. With good cash flows from your credit cards, you can be sure that we will give you reasonable loans. It is enough evidence to show that you have the ability to pay the loan since the money is coming in from customers.

Shark Loans

For the best shark loans in the region, it is advisable to turn to us. Our interest rates are not as high as the other websites. Also, we take the shortest time possible to disburse the loan so that you can sort your emergency.

Funding Companies

We are top on the game when it comes to funding companies in the United States. The company has enough funds to give to your company as long as you meet the set standards. Key to them all is that you should be a legit company with the ability to service the loan.

Funding Companies for Startups

Most of the startup companies on the United States collapse because of insufficient funds. However, that dispensation is over because we have products that are specially designed for startups. The most important thing is for you to have viable business idea. We will assess your potential as a company and then give you the funds that will significantly increase your liquidity.

Funding for Small Companies

We have so many small companies that are struggling with the issues of working capital and you could be one of them. The lack of capital can tarnish your reputation and kill the potential as a small company. We will help you by providing the funds that you need now and even in the future. This is because we have the capacity to fund both small and big companies.

Lines of Credit for New Business

Did you know that even new businesses can get lines of credit from our company? It is easy to speculate your expected cash flows by looking at the nature of your business. Your current income will also help us in establishing your ability to pay.

Lines of Credit for New Businesses

If you are operating a business startup and are in need of lines of credit, we have you covered. Feel free to come to us and we will give you a perfect solution for your needs.

Lines of Credit on Investment Properties

Investment properties can also help you to get lines of credit. The income from your property should be sufficient to cover for the limit.

Business Lines of Credit Interest Rates

Even though lines of credit have a higher interest rate, you stand to pay lower amounts by consuming our products. We have a proven track record of providing the most affordable business lines to our customers.

Lines of Credit Near Me

We offer the best lines of credit near me services. As a result, we have the highest number of happy clients in the region. If you desire to get these loan products, do not hesitate to come to use. We have pocket-friendly rates that will not disappoint you in any way as our customer.

Best Personal Lines of Credit

You can also use lines of credit to borrow for your personal uses. We don’t follow up with you to determine how you will be using the funds. The most important thing is for you to repay your loan in good time.

How Lines of Credit Work

It is not hard to understand hoe the lines of credit work. It is exactly the same way as credit cards operate. You will be given a limit depending in your credit worthiness against which you can borrow the required loan.

How to Get Funding for a Business

Lenders have different procedures when it comes to processing business loans. However, our process is always simple to help in avoiding delays in loan processing.

How to Get Funding to Start a Business

It is not hard to get funding to stat a business. The most important thing is to read the guidelines of the lender and make sure that you meet them. Once you meet the set criteria, you will get the funds that you desire within a short period.

How to Get Funding for Startup

To get funding for your startup, you need to place an application. The loan officers will review it and choose an amount that is fit for your brand. It is a good way to bring the financial struggles of your entity to an end.

Best Funding Options

Even though we have so many funding options for business people, getting a loan is the best. It is easier for a financial institution to trust you with their funds more than even your own family and friends.

Entrepreneur Funding

Very few entrepreneurs can survive without loans in the modern business economy. As lenders, we assess the potential of your enterprise before awarding the loan. Remember it is the enterprise to repay the loan and not you.

Funding for Entrepreneur

Entrepreneurs should not face cash flow issues yet we are here to help them out. We have different products and will choose one depending on your needs.

Social Entrepreneur Funding

Social entrepreneurs face several challenges when trying to acquire a loan. The reason is that most people don’t understand the critical role they play in the society. As a brand, we have been on the frontline when it comes to funding this category of individuals.

Business Capital Loans

Getting capital loans is no longer as hard as it used to be. With a good business idea, you can be sure that we will give you maximum support to get working capital.

Capital for Small Business

Getting capital for your small business can be an uphill task. However, this should not continue to be a bother to you as long as you have a legit enterprise. We invite you to contact us and we will help in funding your entity asap.

Working Capital for Small Business

If you have a small business and are struggling with the issues of limited capital, we have you covered fully. Our company has enough funds to lend to your business regardless of your need. The most important thing is that you should meet the requirements that are stipulated in our lending policy.

Small Business Funding

Some lenders shy away to give loans to business startups because of reasons that they know best. It is very bad to trust a lender who will let you down at the end of the day. To avoid such frustrations, turn to us when you are in need of small business loans. You can be sure that we will not delay in processing your request.

Small Business Funding for Startups

Startups face several challenges and one of them is funding. As you struggle to learn so much about your new venture, we will be working around the clock to make sure that you get the funds to keep your business running.

Small Business Funding Start-Up

If you are planning to start a small business, you should not struggle with the issue of the working capital. As a company, we are willing to give you the funds that you need to start that business as long as your idea is practical. Our officers will walk with your through the path of success.

Small Business Funding Options

There are so many options that small businesses have when it comes to funding. Some of them include using own savings or borrowing from family and friends. The most feasible option is going for a loan because it has more flexible repayment terms.

How to Get Small Business Funding

Business Funding Team is your number one solution for small business loans. The amount that we approve virtually depends on the capacity of your enterprise to repay the loan.

Business Credit Line

The demand for business credit line in the United States has been on the rise. It is one of the easiest ways to get money especially when you need it urgently. The most important thing is for the bank to give you a limit and then you can use it upon need. The interest that you pay is only for the amount of money that you consume within that particular period.

Business Credit Builder

The business builder is an effective but simple way of building the credit worth of your business whether it is an existing premise or a startup. It will help you to qualify for a loan within the shortest time possible. If you feel like you need one for your brand, you are welcome to contact us and we will give you maximum support.

How to Build Business Credit

The best way to build good credit history for your business is by paying your loans on time. If you take a loan with us, we will forward your repayment details to the credit bureau from time to time. This will help you to build your business credit especially if your loans don’t fall into areas.

Funding for Startup Business

Liquidity is one of the defining elements of a successful business and the economic environment of the United States is not an exemption. However, it is a challenge that is so real especially when dealing with startups. However, the lack of funds should not continue to trouble you as an investor. We offer the best funding for startup business that you will not find in any other place in the region.

Funding for Entrepreneurship

Most of the successful entrepreneurs you see out there fully rely on loans to succeed. You will rarely get one who achieved high standards of success without support from loans. As a lending company, we have a broad range of products that are specially designed for entrepreneurs. You will not miss out on these golden opportunities if you choose us to be your financial partner.

Funding for Startup Nonprofits

Very few lenders in the United States are willing to fund startup nonprofits. However, you can count on us if you are in the process of starting such an entity. We have products that are specially designed to help in funding this category of users. Just come to us and you can be sure that we will not let you down in any way.

Funding for Startup Restaurants

Starting a restaurant is not an easy endeavor. You need enough funds to buy enough food, cooking machines, furniture, salary and many more. It is hard to save until you are able to set up a successful restaurant business. It can take you the rest of your life but you still find the idea to be impossible. Because of this, we have special loans that are designed for startup restaurants.

Funding for Social Entrepreneurs

We offer lending products that are specially designed for social entrepreneurs. These are people who launch products to help in solving the social, environmental, and cultural issues that people all over the world go through. If you are one of them, don’t hesitate to come to us for the best deals in loans.

Funding for Tech Startup

The whole world is moving towards tech and hence there is a need for more people to invest in this industry. It is because of this that we give people who are planning to invest in the tech industry some special considerations. You will get loans to startup your tech firms at very competitive rates.

Funding for Female Entrepreneurs

The female gender needs some special attention when it comes to giving out loans. As we strive to work towards women empowerment, we have very special products for our women. You can get loans at interest rates that are quite friendly. It is because of this that we have so many women coming to us for loans on a daily basis.

Funding for My Startup

Most people really struggle when looking for startup funding. Lenders find it hard to determine your ability to pay if your business is still new. However, this will not be a problem if you turn to us. The company will be able to give you very affordable loans for your startup.

Restaurant Funding

One of the best businesses that you can open in the United States is a restaurant. People lead very busy lifestyles with very little or even no time left to prepare meals. Therefore, you cannot go wrong with the hotel business as long as you prepare high-quality food. Business Funding Team comes in handy to give you the money that you need to run the restaurant business.

Funding for Restaurant Startup

To start a restaurant, you will need to pay rent, buy stock, and other hotel equipment. Meeting all these obligations is not easy especially if you are a young investor. You can have a good business idea but funding can become a problem. We are here to make sure that your dreams come true when looking for funding for restaurant startup.

Funding for Gyms

You cannot succeed in running a gym unless you have modern equipment to help you with the same. The challenge is that you need a lot of funds to run a high-end facility. Most of the successful investors out there are using loans to equip their training centers. Feel free to come to us when you need funding for gyms so that you can give your customers an exemplary experience during workouts.

Funding for Yoga

To run a successful yoga training, you need highly specialized machines. No one will come to your fitness center if you still rely on old-school equipment. There is no need to chase away your business when we are willing to give you funding for yoga equipment. You can be sur of getting low-cost loans that will give your customers an experience of its own.

Funding for Fitness Programs

It is very expensive to but the equipment that you need to run a fitness program. The number of customers that you get depends on quality of equipment in your premise. Don’t chase away customers yet we can help you in funding some of these machines. It will take us a very short time and we will help you to take your business to the next level. It is for this reason that the most successful entrepreneurs turn to us when in need of funding for fitness programs. We can confidently say that we are a one-stop shop for all your fitness program needs.

Here at Business Funding Team, we love educating you on the funding process, whether you are a startup or an established business. So below are two of our preferred funding partners that we highly recommend. Business Funding Team have provided the top funding solutions for thousands of entrepreneurs nationwide. You can read about them by clicking either of the two buttons below

Here is an overview of the loan products that we provide to our customers in the region.

- Startup Funding

- Startup Funding for Business

- Startup Funding for Small Business

- Startup Funding Website

- Startup Funding For Nonprofits

- Startup Funding Companies

- Startup Funding Options

- Startup Funding Sources

- Startup Funding Stages

- Startup Funding Online

- How Startups Get Funding

- Business Funding

- Business Funding For Startups

- Business Funding Solutions

- Business Funding With Bad Credit

- Business Funding Fast

- Small Business Funding

- Business Funding Partners

- Business Funding For Veterans

- Business Funding Group

- Business Funding Capital

- Small Business Loans

- Small Business Loans For Woman

- How to Get Small Business Loans

- Small Business Loans for Startups

- Small Business Loans for Veterans

- Small Business Loan Rates

- Small Business Loans Near Me

- Rates for Small Business Loans

- Small Business Loans for Minorities

- How Do Small Business Loans Work

- Small Business Loans New Business

- Small Business Loans Online

- Small Business Loans for Disabled Veterans

- Qualifications for Small Business Loans

- Small Business Loans Unsecured

- Where to Get Small Business Loans

- Small Business Loans Quick

- Small Business Loans Companies

- Small Business Loans Amount

- Unsecured Loans

- Unsecured Loans Personal

- Unsecured Loans vs Secured

- Unsecured Loans for Business

- Unsecured Loans Online

- Unsecured Loans Debt Consolidation

- Unsecured Loans to Consolidate Debt

- Unsecured Loans Rates

- Rates for Unsecured Loans

- Unsecured Loans Near Me

- Unsecured Loans Interest Rates

- Unsecured Loans for Veterans

- Unsecured Loans Types

- Unsecured Loans Best Rates

- Unsecured Loans Low Interest

- Unsecured Loans Companies

- Creative Financing

- Creative Financing Options

- What is Creative Financing

- Creative Business Financing

- Creative Financing Ideas

- Creative Financing Strategies

- Creative Financing Solutions

- Real Estate Investor Loan

- Real Estate Investor Financing

- New Venture Funding

- Secured Loans

- Secured Loans Online

- Secured Loans for Bad Credit

- Secured Loans with Bad Credit

- Secured Loans for Business

- Secured Loans vs. Unsecured Loan

- Secured Loans Rates

- How Does Secured Loans Work

- Secured Loan Debt Consolidation

- Secured Loan Collateral

- Secured Loans Types

- Startup Business Loan Bad Credit

- Startup Business Funding

- Business Funding for Startup

- Startup Business Loan Rates

- How to Get Startup Business Funding

- SBA Loans

- SBA Loans Requirements

- SBA Loans Rates

- SBA Loans 504

- SBA Loans Disaster

- SBA Loans for Veterans

- SBA Loans for Women

- SBA Loans Business

- SBA Loans Interest Rate

- Terms for SBA Loans

- SBA Loans Real Estate

- SBA Loans Types

- SBA Loans for Small Business

- SBA Loans Programs

- SBA Loans Application

- MCA Loans

- MCA Business Loans

- Merchant Cash Advance

- Merchant Cash Advance Companies

- Merchant Cash Advance Loan

- What is Merchant Cash Advance

- Merchant Cash Advance Bad Credit

- Shark Loans

- Shark Loans Online

- Shark Loans Bad Credit

- Funding for Companies

- Funding Companies

- Funding Companies for Startups

- Funding for Small Companies

- Business Lines of Credit

- Lines of Credit for Business

- Lines of Credit Loans

- Lines of Credit Personal

- Lines of Credit for Small Business

- Lines of Credit Online

- How do Lines of Credit Work

- Equity Lines of Credit Rates

- Lines of Credit Rates

- Interest Rates for Lines of Credit

- Lines of Credit vs. Loan

- How to Get Lines of Credit

- Business Lines of Credit Rates

- Apply for Lines of Credit

- Lines of Credit Loans for Bad Credit

- Lines of Credit for New Business

- Lines of Credit for New Businesses

- Lines of Credit on Investment Properties

- Business Lines of Credit Interest Rates

- Lines of Credit Near Me

- Best Personal Lines of Credit

- How Lines of Credit Work

- How to Get Funding for a Business

- How to Get Funding to Start a Business

- How to Get Funding for Startup

- Best Funding Options

- Entrepreneur Funding

- Funding for Entrepreneur

- Social Entrepreneur Funding

- Business Capital Loans

- Capital for Small Business

- Working Capital for Small Business

- Small Business Funding

- Small Business Funding for Startups

- Small Business Funding Start-Up

- Small Business Funding Options

- How to Get Small Business Funding

- Small Business Funding Companies

- Business Credit Line

- Business Credit Builder

- How to Build Business Credit

- Funding for Startup Business

- Funding for Entrepreneurship

- Funding for Startup Nonprofits

- Funding for Startup Restaurants

- Funding for Social Entrepreneurs

- Funding for Tech Startup

- Funding for Female Entrepreneurs

- Funding for My Startup

- Restaurant Funding

- Funding for Restaurant Startup

- Funding for Gyms

- Funding for Yoga

- Funding for Fitness Programs